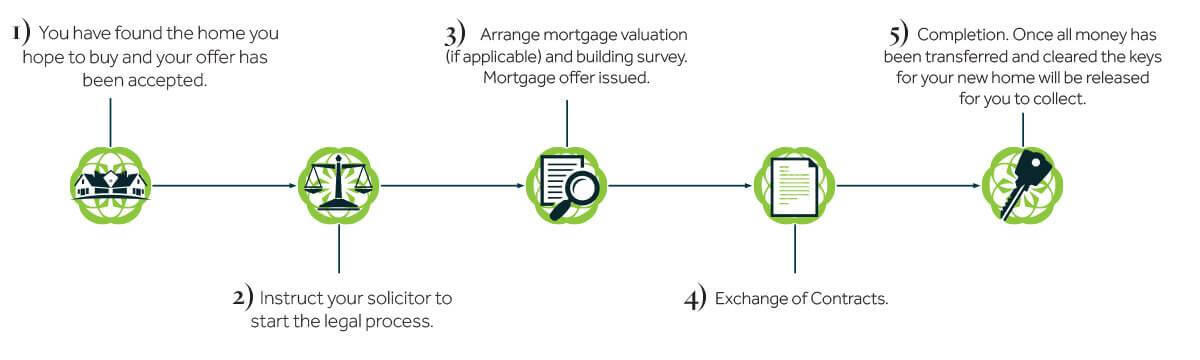

The buying process

- Offer accepted

Once your offer has been accepted it is worth asking the seller to take the property off the market to avoid a bidding war with any other interested parties. - Instruct a solicitor

Choosing an efficient solicitor is crucial and can make all the difference to the speed and efficiency of the transaction. We can make recommendations if required. You will need to complete an information form which will include your source of funds and any money provided by a third party, along with ID for anti-money laundering checks. Take a look at our legal services for more information. - Valuation and survey

If applicable, contact your mortgage provider to arrange a valuation. Most mortgage advisors will insist on a valuation report to confirm that the property offers sufficient security to cover the loan. If you are a cash buyer it is advisable to have the property surveyed and depending on the level of detail required these typically range in cost from £150 to approximately £1,200. During this time the seller’s solicitor will send a draft contract and other legal documents to your solicitor. Your solicitor will check the legal title of the property and raise any ‘Requisitions on Title’. S/he will also conduct the necessary searches, including any relevant planning applications, building control history, and development restrictions among others. Upon receipt of your mortgage offer your solicitor will send you the mortgage deed and contract in readiness for exchange, along with a legal pack including fixtures and fittings. Your solicitor will prepare the transfer deed and send to the seller’s solicitor. The deposit amount should be agreed and you should transfer this to your solicitor. - Exchange of contracts

This forms a legally binding commitment to both parties and takes place once all enquiries have been agreed. At this point it is not possible to change the agreement or withdraw from the transaction without incurring a financial penalty. The deposit, which is usually 10% of the purchase price, will be transferred from your solicitor to the seller’s solicitor. The completion date is set and forms part of the contract. Contracts typically exchange between 5 and 28 days before completion. However, on some occasions, especially where cash buyers are involved, exchange and completion can sometimes occur on the same day. - Completion

Your solicitor will transfer the residual amount of money to the seller’s solicitor and obtain the signed transfer. Once all of the money has cleared in the seller’s solicitors’ account you will be able to pick up the keys to your new home. Your solicitor will register the transfer of ownership with the Land Registry and arrange for any stamp duty to be paid. This is now the time to notify the utility companies that you are the new owner of the property; inform your bank, place of work, mobile phone company and the DVLA of your new address and set up a post-redirection service.